High School - Basic Math Models

Spreadsheets and Finances

Quality: Technology Literate-Discern and Synthesize Information; Use technology as a tool to accomplish tasks and be a life-long learner

Evidence: Students had to learn how to use spreadsheets to learn how to understand simple interest, compound interest, and business loans.

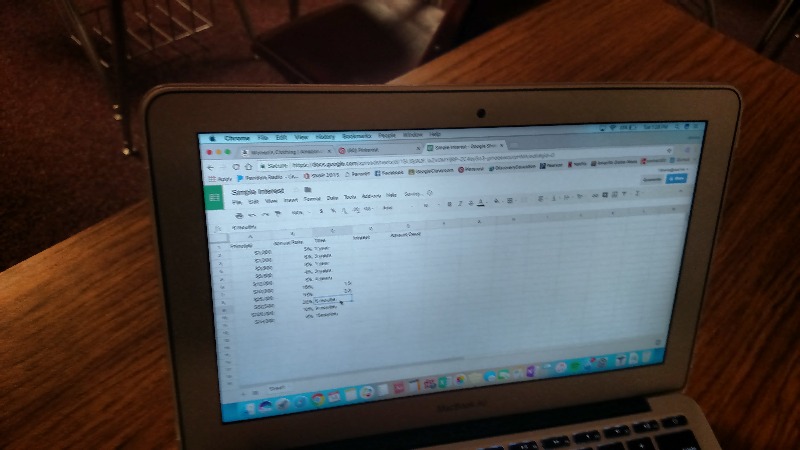

Simple Interest:First, the students had to recognize and understand how to get interest. Next, they had to determine if it was annually or monthly interest rate. Then, the students had to compute amount owed for a specific principal, annual rate, and time. Once the students had their spreadsheets set up, they had to determine what the formula to use in order to complete the spreadsheet for each column. The objective for this lesson was to compute simple interest, given principal, rate, and time.

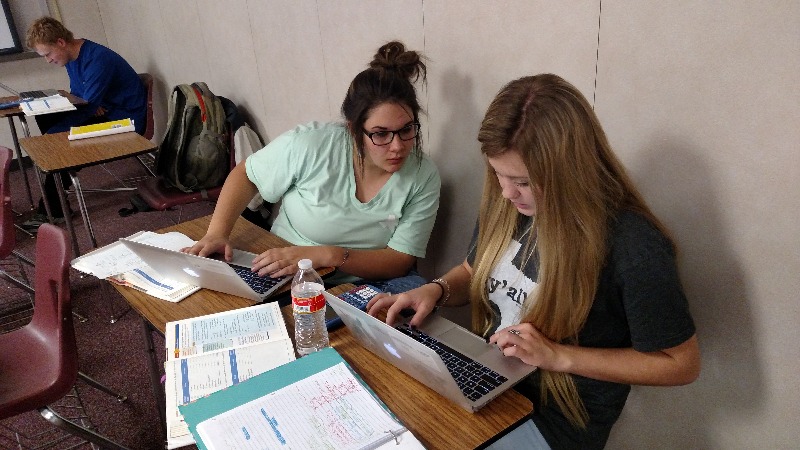

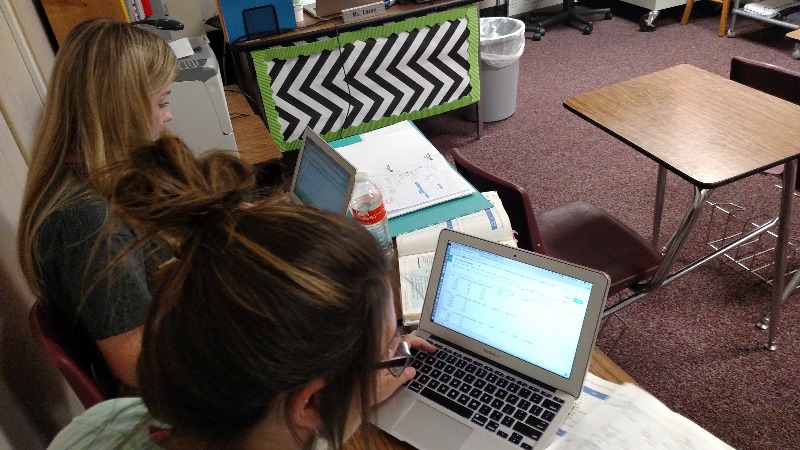

Compound Interest: Students had to figure out the formulas for monthly interest rate, how many months had to be figured for each scenario, and what the total amount owed. After they had the formulas for the first line, each student had to come and verify if the formulas were correct before continuing on with the assignment. The ladies decided to work together and discuss their formulas on the first day. Each student chose to work individually the second day. Each student had to apply his/her knowledge about simple interest and compound interest to walk themselves through the process. At times, students had to remember to change the annual rate to a decimal form before figuring out how to complete the process. This lesson was a definite multi-step process. The objective for this lesson was to compute the new amounts owed when interest is compounded semiannually, quarterly, and monthly.

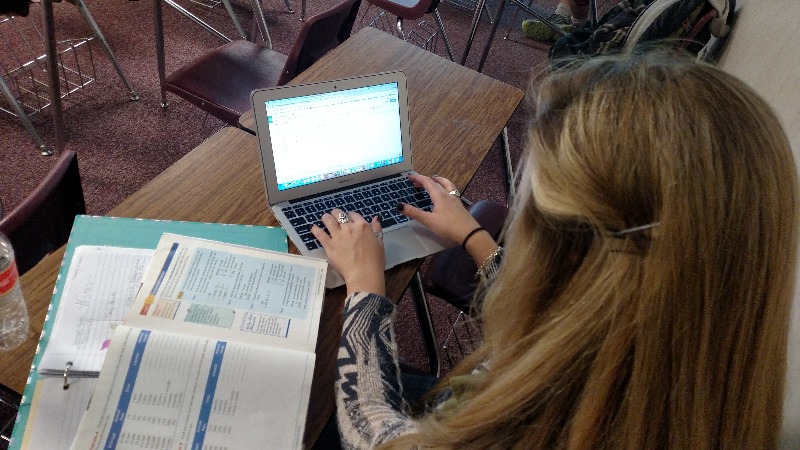

Business Loans: Each student had to apply the knowledge learned from simple interest and compound interest in order to figure out how much line of credit was needed for each scenario. Again, this was a multi-step process where prior knowledge was a requirement and annual rate had to be converted before figuring out interest. The objectives for this lesson was to determine lines of credit based on a company’s value and to calculate interest on credit for given periods of time.

Cash Flow: The objectives for this lesson are understand cash flow, explain why managing cash flow is important, and use short-term credit to manage cash flow. Students have to figure out the Total Revenue and Total Expenses for a business and determine if the cash flow is a positive or a negative one. They had to figure out how much money a company needed to borrow in order to meet expenses for a specified month.

Launch the media gallery 1 player - media #1

Launch the media gallery 1 player - media #1 Launch the media gallery 1 player - media #2

Launch the media gallery 1 player - media #2 Launch the media gallery 1 player - media #3

Launch the media gallery 1 player - media #3 Launch the media gallery 1 player - media #4

Launch the media gallery 1 player - media #4 Launch the media gallery 1 player - media #5

Launch the media gallery 1 player - media #5 Launch the media gallery 1 player - media #6

Launch the media gallery 1 player - media #6 Launch the media gallery 1 player - media #7

Launch the media gallery 1 player - media #7 Launch the media gallery 1 player - media #8

Launch the media gallery 1 player - media #8 Launch the media gallery 1 player - media #9

Launch the media gallery 1 player - media #9 Launch the media gallery 1 player - media #10

Launch the media gallery 1 player - media #10